Your Wedding,

Your Way

Your Wedding,

Your Way

Finance the wedding of your dreams.

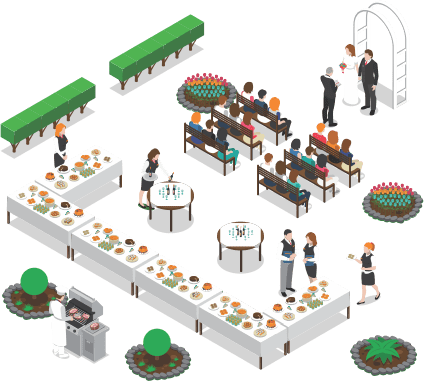

From centerpieces to soundtracks, there’s a lot you have to think about when planning your wedding. A wedding loan from Mariner Finance might help relieve the financial stress so you can spend less time worrying about paying the caterer and more time enjoying your special day

TheKnot.com said the national average wedding cost is around $33,391. It’s true, getting married can be expensive, but we are here to help

74% of couples planned to borrow money for their wedding finances and 21% actually take out a loan to do so according to a 2017 study. [I]

Personal wedding loans are a great way to finance the wedding of your dreams. Your wedding day should be stress-free without putting a huge strain on your bank account.

Enjoy your wedding day, honeymoon, and the flight back home knowing you had the experience of a lifetime.

How our wedding loans work.

Our wedding loans give you the benefit of a fixed interest rate and fixed monthly payment, making it easier to manage your expenses. Funding your wedding has never been easier. The process is a simple: apply now and you may be able to get the money you need in as little as a day. We offer loans from $1,000 to $25,000.

Why choose

Mariner Finance?

Our experienced and licensed loan officers make it their business to educate customers and create loan solutions that fit the individual. Their mission is to make the process simpler, not the other way around. Because the more informed you are, the better decisions you make—not just today, but years from now as your needs change.

How has Mariner come through for you?

Useful Articles

Personal

loans for

when life

happens

Got questions?

Get answers.

What is the minimum amount I can borrow? How long does an application take? Is there a prepayment penalty?

Ready to speak to a

person—in person?

You have your own unique goals to meet, and it all starts with a 5 minute conversation with one of our team members. You can reach us directly at 877-310-2373.

What is a

personal loan?

Great question. It’s a loan that may help you deal with an unexpected expense, see a new part of the world, or simply help you achieve your personal goals.